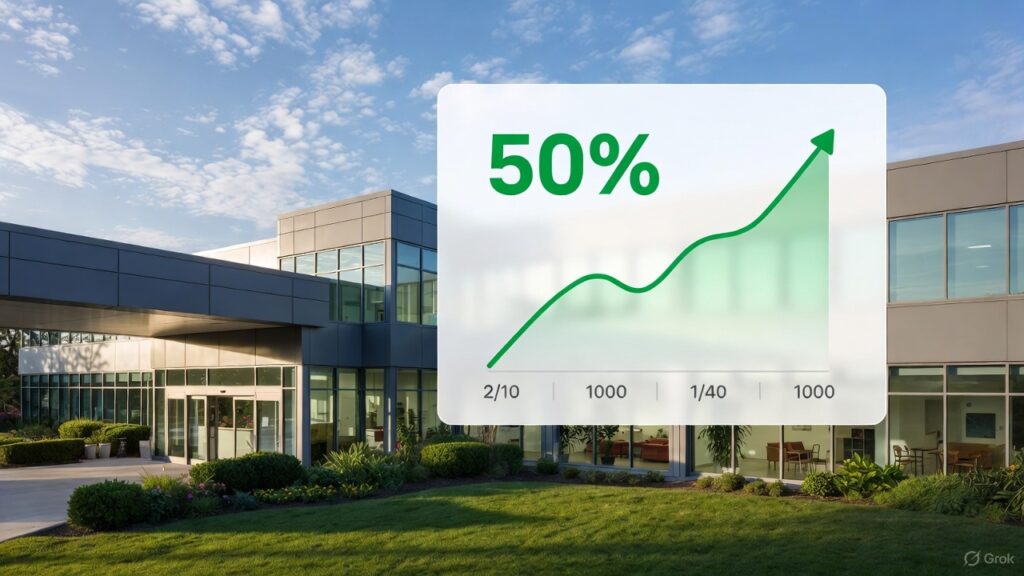

Whoa, talk about a market mover! If you’re scanning the boards today, you’ve probably spotted PACS Group making waves with one of the biggest jumps out there. As of this writing on November 20, 2025, shares are up over 50%, hitting new highs around the $25-27 range. What’s got everyone buzzing? Let’s dive in and break it down, because moves like this are a great chance to talk about how the stock world really works.

What’s Behind the Big Jump?

PACS Group, a player in the healthcare space focusing on after-hospital care like nursing homes and assisted living, just dropped their third-quarter numbers, and boy, did they deliver. Revenue clocked in at about $1.34 billion, that’s a solid 31% jump from last year. And the bottom line? Net income soared to $52.4 million, more than tripling from the $15.6 million they posted a year ago. Investors love seeing growth like that—it shows the company’s firing on all cylinders.

Now, as of this writing, the stock’s trading in the $25-27 range, up big from yesterday’s close. Volume’s through the roof too, with millions of shares changing hands. It’s classic earnings reaction: good news hits, and the price pops. But remember, markets can swing fast, so always keep an eye on the tape. All figures here are as of this writing and subject to real-time fluctuations.

Breaking Down What These Numbers Mean

Okay, let’s keep it simple. Revenue is basically how much money the company brings in from its services. That 31% growth means they’re expanding, maybe adding more facilities or getting more patients through the door. The net income boost? That’s after paying all the bills—shows they’re not just growing but doing it profitably. In healthcare, where costs can be high, this kind of efficiency stands out.

Looking ahead, the team’s optimistic, guiding for full-year sales between $5.25 billion and $5.35 billion. That’s the kind of forward-thinking that gets Wall Street excited. But hey, forecasts are just that—educated guesses. Things like changes in healthcare rules or economic shifts can throw a wrench in the works.

Risks and Upsides in Stocks Like PACS

Healthcare stocks can be a wild ride. On the plus side, with folks living longer, demand for services like what PACS offers is only going up. It’s a sector that’s often seen as steady because people need care no matter what the economy’s doing. Strong earnings like these can highlight a company’s edge in a crowded field.

But let’s be real—there are pitfalls. Government regulations can change overnight, squeezing margins. Competition’s fierce, and if costs for staff or supplies spike, it hits the bottom line hard. Plus, stocks that jump this much on news can pull back just as quick if the hype fades. It’s all about weighing the potential rewards against those bumps in the road.

Lessons from Similar Market Moves

Speaking of hype, we’ve seen this play out before. Take UnitedHealth—when they beat earnings expectations a while back, shares climbed nicely, sometimes 5-10% in a day. Pfizer’s popped 15% or more on strong results from their drug pipeline announcements. Even smaller players like Hims & Hers have surged after topping revenue forecasts, drawing in more users to their platforms.

On the flip side, not every earnings win sticks. Some healthcare names have dipped after initial pops if broader market worries creep in, like inflation or policy shifts. It’s a reminder: past moves don’t guarantee the future, but they show how positive surprises can fuel rallies, while misses can send prices tumbling.

Trading Smarts from Today’s Action

Moves like PACS today are textbook examples of why earnings season is so exciting—and nerve-wracking. It teaches us to watch for surprises: when a company beats what the Street expects, it can ignite buying. But smart trading means doing your homework, understanding the business, and not chasing every hot stock. Diversify, set stops, and think long-term. The market’s full of opportunities, but it’s also got its share of traps.

Want to stay on top of these kinds of alerts without glued to your screen? Sign up for free daily stock alerts by tapping here: https://bullseyeoptiontrading.com/bet-rbwebsite/?el=de. It’s a easy way to get bites of market info straight to your phone.